21/08/2023

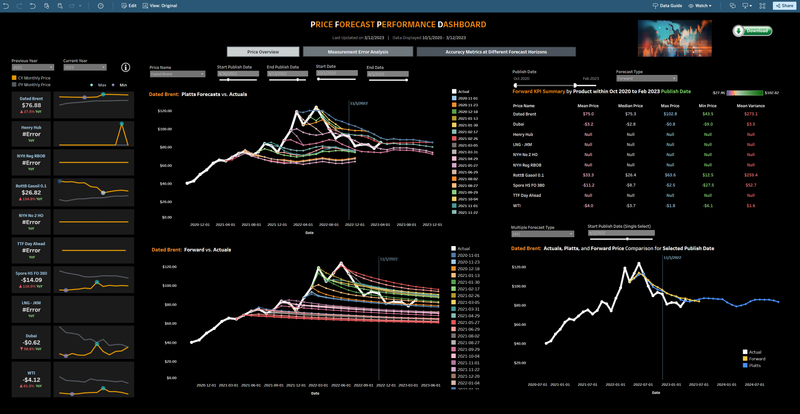

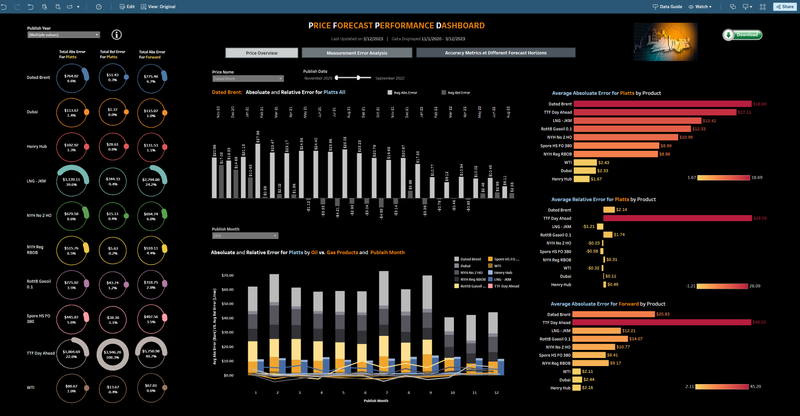

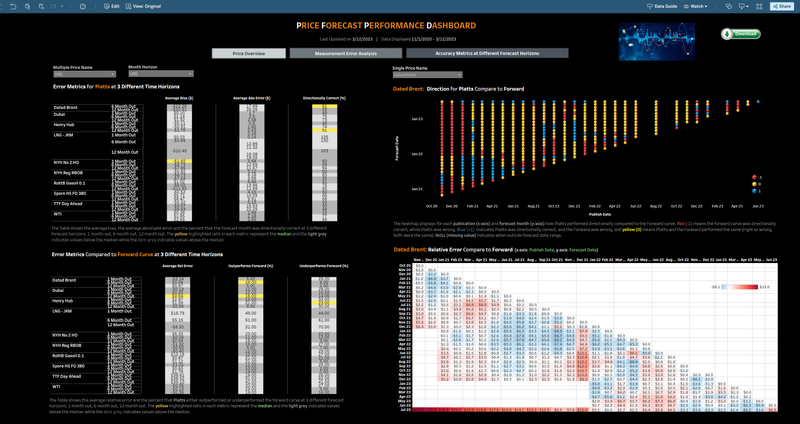

Oil and Gas Price Forecasts and Forecast Accuracy Metrics - S&P Global Commodity Insights, 2024

Developed five key accuracy metrics to evaluate the performance of 20 mainstream oil and gas price forecasts and forward curves, providing critical insights for 23 proprietary hedge funds. Created an interactive Tableau dashboard to visualize price forecasts and accuracy metrics for these datasets, streamlining manual reporting and saving around 5 hours each week.

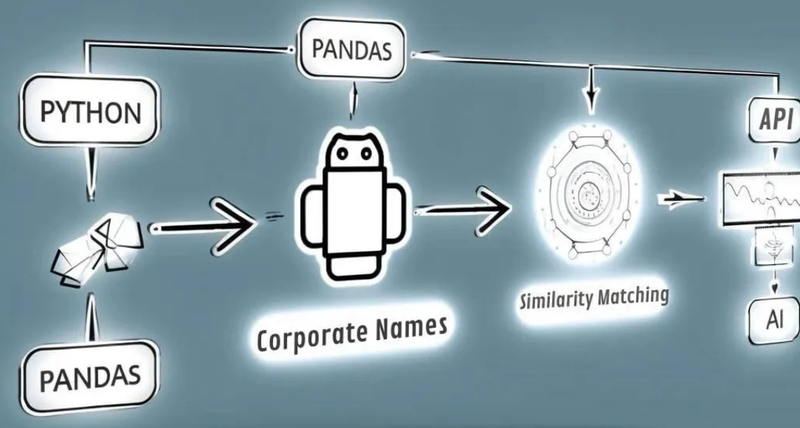

Fuzzy Matching Company Names - S&P Global Market Intelligence, 2022

Built a powerful string matching engine to deduplicate over 40,000 company names, accounting for variations in legal structures, abbreviations, omissions, and typographical errors. Leveraged Natural Language Processing (NLP) with a TF-IDF vectorizer to ensure efficient and accurate company name standardization.

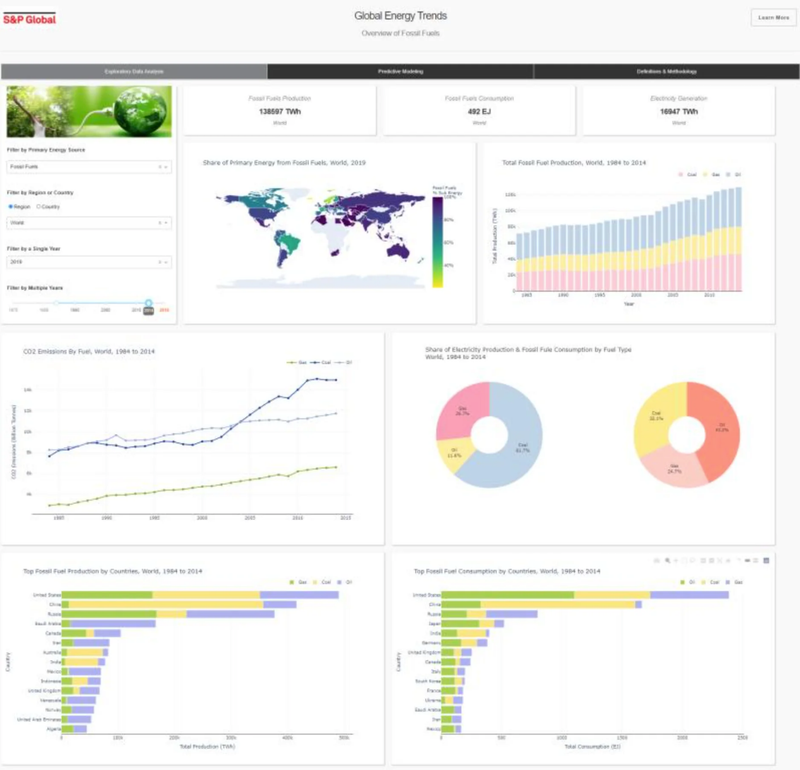

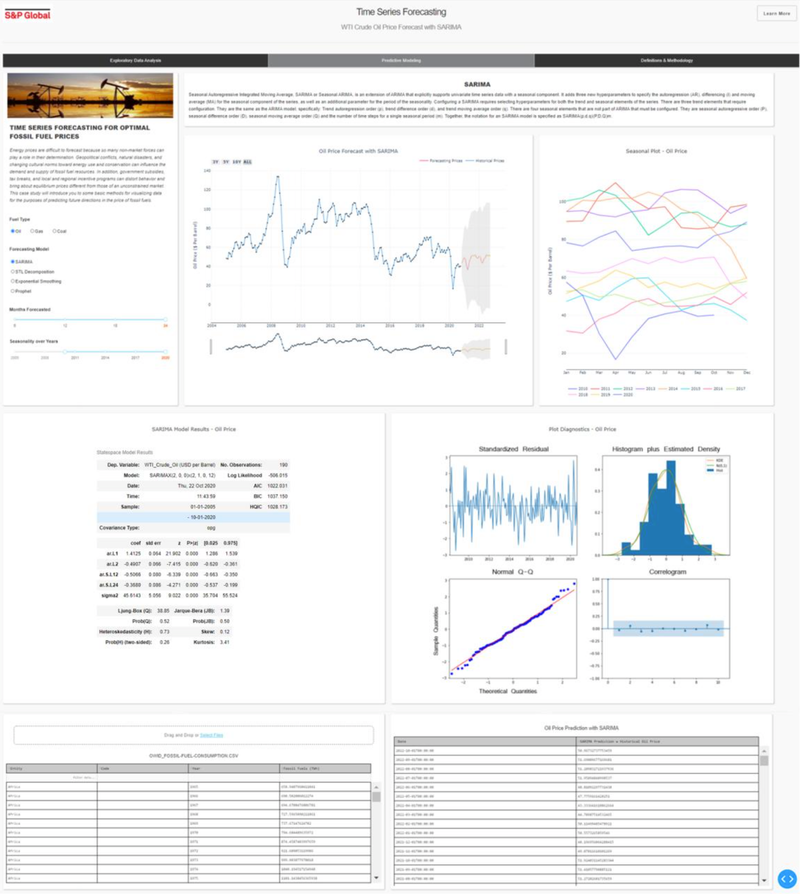

Global Energy Trends with Fossil Fuel Price Prediction - S&P Global Market Intelligence, 2022

Developed an interactive web interface using Python Dash and Plotly to provide insights into global energy trends and predict fossil fuel prices. Applied advanced time series models, including Seasonal ARIMA, STL Decomposition, Exponential Smoothing, and Prophet, to forecast energy prices and present valuable data-driven insights.

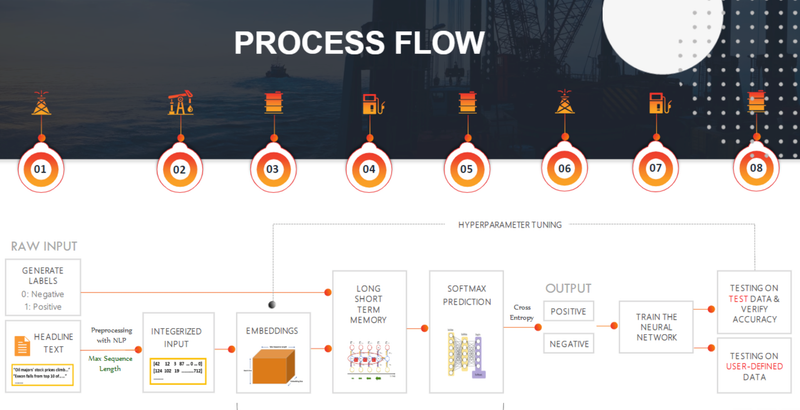

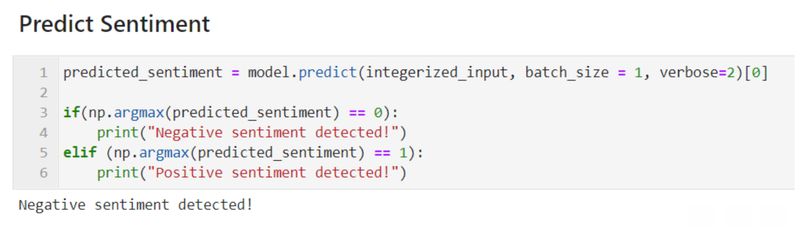

Energy Market Sentiment Analysis with NLP and LSTM - S&P Global Market Intelligence, 2021

Used Long Short-Term Memory (LSTM) neural networks combined with NLP techniques to analyze the sentiments behind energy-related news headlines and predict how they affect the index value in the oil and gas industry. This approach provided a deeper understanding of market dynamics driven by sentiment, offering critical insights into market behavior.

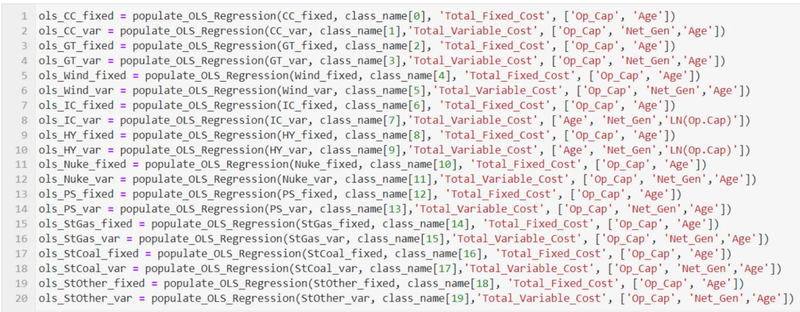

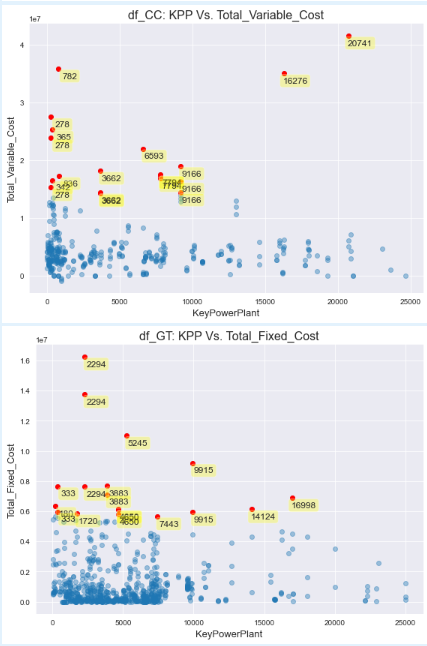

Prediction of Capital and Operating Costs of Power Plants - S&P Global Market Intelligence, 2020

Applied multivariate regression to predict future capital expenditures and operating costs of U.S. power plants, accounting for various fuel and technology types. This analysis enabled more accurate financial forecasting, supporting decision-making across different plant configurations and cost structures.

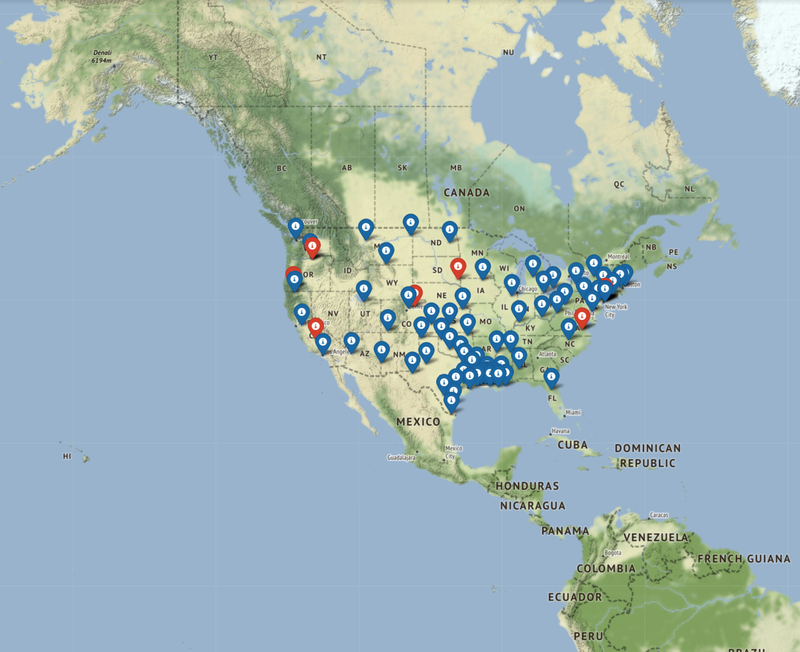

Mapping Gas Power Plants to a Gas Hub in the U.S. - S&P Global Market Intelligence, 2019

Built a Python application to map U.S. gas power plants to their nearest gas hub district using the K-Means clustering algorithm and Vincenty distance function. This mapping ensured that each power plant was within a 12-mile radius of every other plant in the hub, helping optimize distribution networks and improve logistical efficiency.